A Publisher Faces The Following Demand Schedule

Posted : admin On 16.09.2019- A Publisher Faces The Following Demand Schedule For The Next

- A Publisher Faces The Following Demand Schedule For The Next Novel

I am on the chapter for monoplies. I need to calculate the total cost for the following question. I am not quite clear if I am to use the $2 million that was paid to author to write the book to calculate the total cost, since the question is stating that the marginal cost has been a constant $10 per book?

A music studio faces the following demand schedule whenreleasing the next Compact Disc by U2. The studio must pay U2 $10million to make the CD, and the marginal cost of printing the CD isalways $3 per disc. P is price, in dollars; Q is quantity demanded,listed in millions of CDs.

Calculate totalrevenue, marginal revenue, fixed cost, marginal cost, variablecost, total cost, and profit for each quantity listed (if a columnis in millions, please label it accordingly).Price Q TR MRFC MC VC TCProfit18 0 – –17 116 215 314 413 512 611 710 89 98 10What price and quantity woulda profit-maximizing music studio choose? Whatprofit will the studio make?Show this problem graphically by graphing the Demand curve, MR,and MC, labeling everything relevant, including the equilibriumprice and quantity. Show Consumer and Producer Surplus. Also showthe deadweight loss of monopoly.

A Publisher Faces The Following Demand Schedule For The Next

How much would the firm produce ifit was owned by the government and trying to maximize economicefficiency (make total surplus as big as possible)?Assume this demand curve is representative of demand for any U2CD. What is the most money they could ask for in order to maketheir next CD that would still allow the firm to produce the CD?( Please answer the following hints: how do fixedcosts affect the firm’s decisions on price and quantity?

What isthe minimum amount of economic profit a firm needs to still makethe product? Therefore, how much money could U2 make while stillallowing the studio to stay in business?).

A Publisher Faces The Following Demand Schedule For The Next Novel

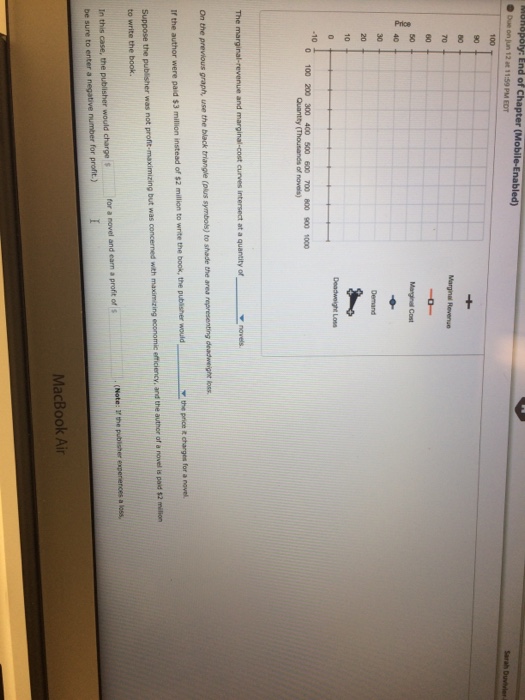

Question: A publisher faces the following demand scheduleA publisher faces the following demand schedule for the next novel from one of its popular authors:Price Quantity. Demanded$100 0 novels90 100,00080 200,00070 300,00060 400,00050 500,00040 600,00030 700,00020 800,00010 900,0000 1,000,000The author is paid $2 million to write the book, and the marginal cost of publishing the book is a constant $10 per book.a. Compute total revenue, total cost, and profit at each quantity.

What quantity would a profit maximizing publisher choose? What price would it charge?b. Compute marginal revenue. (Recall that MR = ΔTR/ΔQ.) How does marginal revenue compare to the price? Graph the marginal-revenue, marginal-cost, and demand curves. At what quantity do the marginal revenue and marginal-cost curves cross?

What does this signify?d. In your graph, shade in the deadweight loss. Explain in words what this means.e. If the author were paid $3 million instead of $2 million to write the book, how would this affect the publisher’s decision regarding what price to charge? Suppose the publisher was not profit-maximizing but was concerned with maximizing economic efficiency. What price would it charge for the book? How much profit would it make at this price?